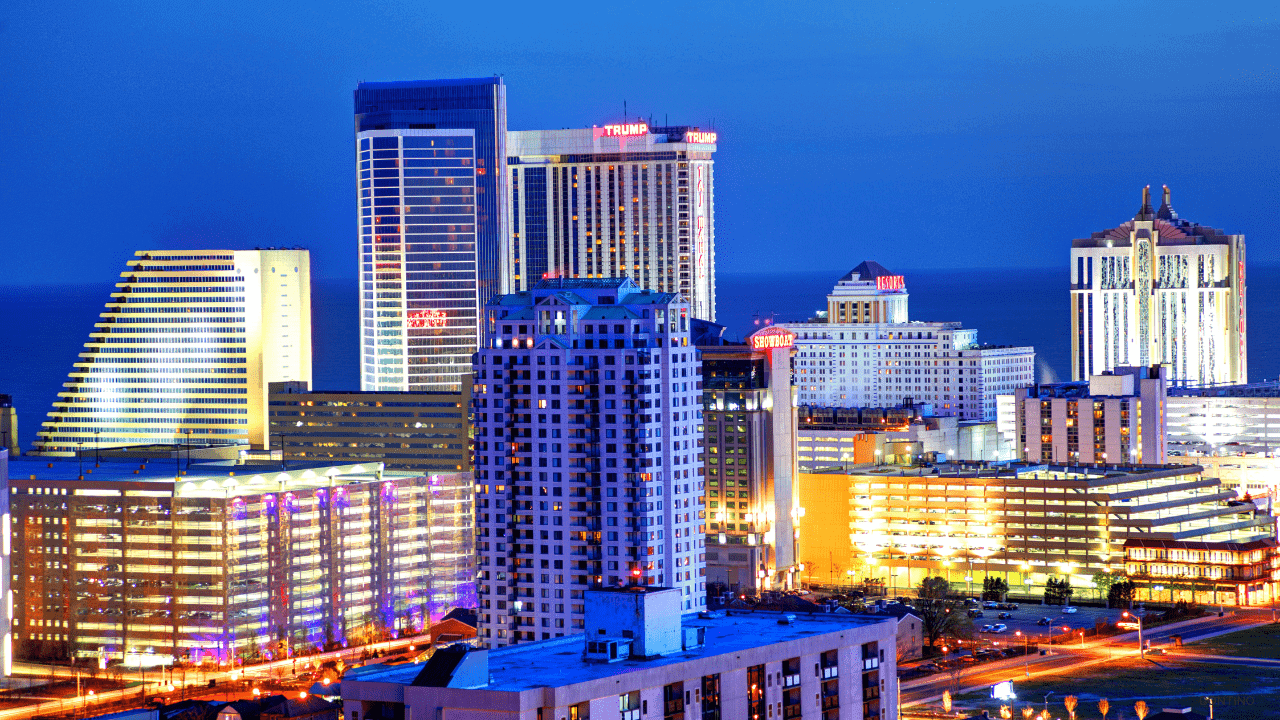

Atlantic City Casinos’ Profits Drop by 7.5% in Q3 2023

Atlantic City’s gambling landscape, comprising casinos and two exclusive online platforms, saw a third-quarter revenue of $281.2 million, marking a 7.5% decline from the corresponding period last year, according to New Jersey gambling regulators on Tuesday.

Atlantic City Casinos’ Profits Drop by 7.5% in Q3 2023

Data from the state Division of Gaming Enforcement revealed that while the nine casinos collectively exceeded their profitability from the pre-pandemic third quarter of 2019, the boost was primarily attributed to the robust performances of the two newest casinos and an accounting adjustment by another establishment.

In the third quarter, Hard Rock achieved a gross operating profit of $44.3 million, a modest increase of less than 1% from the previous year. Meanwhile, the Ocean Casino Resort reported a profit of $43 million, reflecting a substantial growth of over 10% compared to the same period last year.

Jane Bokunewicz, director of the Lloyd Levenson Institute at Stockton University, observed a cooling off in Atlantic City’s summer of 2023 compared to the heightened post-pandemic activity witnessed in 2021 and 2022. However, she noted that the city outperformed pre-pandemic levels in both net revenue and gross operating profit, suggesting a potential cycle of stabilization.

The Borgata reported a profit of $73.5 million, a 1.7% decrease from the previous year. The gaming enforcement division clarified that a recent change in the treatment of rent expenses significantly boosted the reported gross operating profits of the Borgata.

Also See: The Battle to Preserve North American Right Whales from Extinction

Among internet-only entities, Caesars Interactive Entertainment NJ reported a $5.1 million profit, down 18%, and Resorts Digital posted a profit of nearly $1.6 million, down nearly 50%.

Regarding casino hotel room occupancy rates in the third quarter, Hard Rock led with over 96%, while Golden Nugget had the lowest at just over 67%. The highest average nightly room price was $346.87 at Ocean, while Resorts had the lowest at $147.89.