Could New Jersey’s Ocean Wind Farm Be Cancelled?

On August 29th, Ørsted, the company that is looking to build wind farms off the coast of New Jersey, announced significant delays and anticipated impairments on its US offshore wind projects.

This announcement has sent ripples through the renewable energy industry, raising questions about the viability of these projects and their impact on the company’s financial outlook.

Simultaneously, it has instilled optimism among New Jersey residents who are opposed to the project off their coastline, raising hopes that this endeavor may ultimately face cancellation.

Let’s talk about what is going wrong for Ørsted and if the whole project could be canceled.

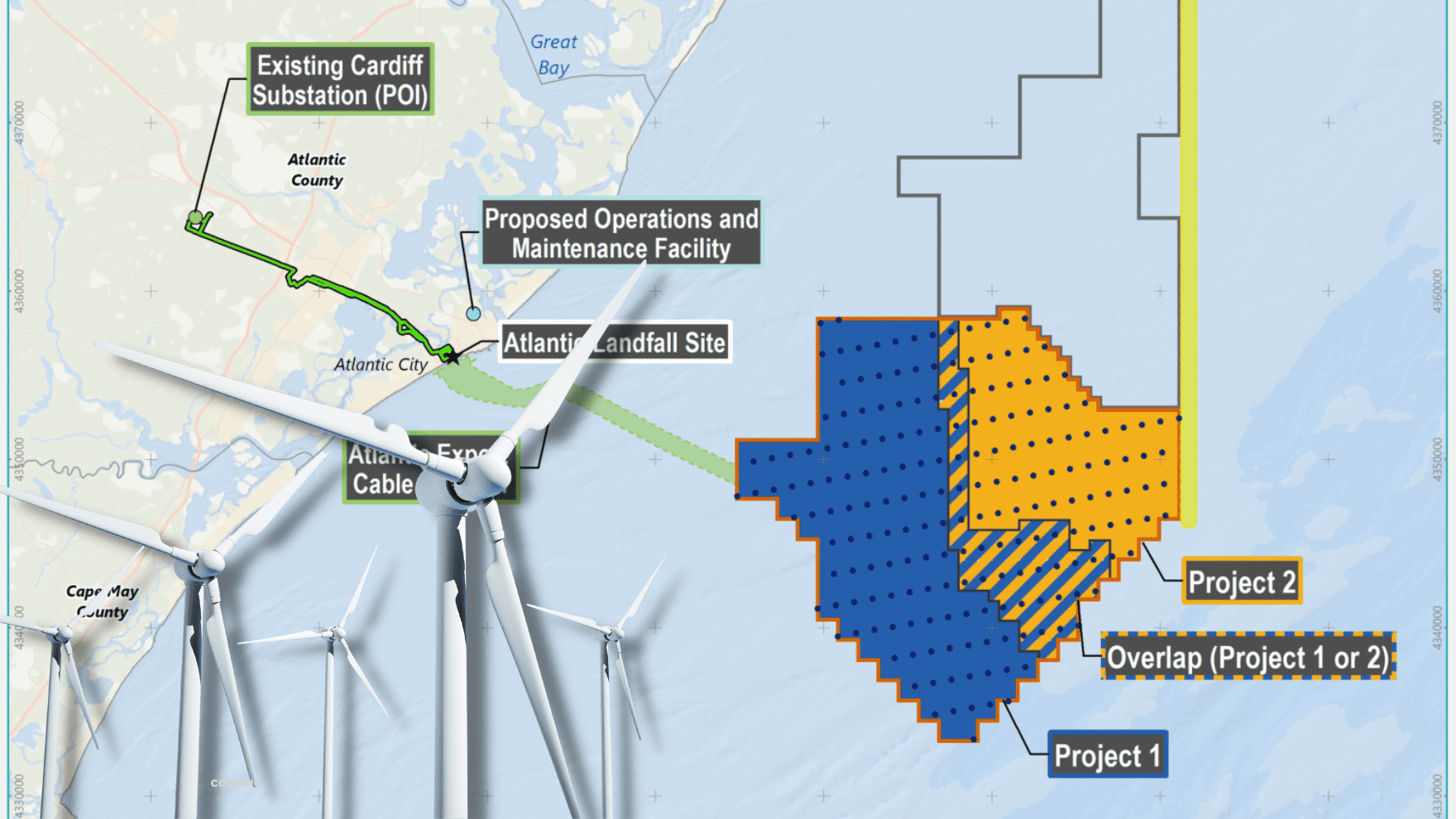

Ocean Wind 1 is the wind turbine project that is proposed off the beaches of Ocean City and is supposed to be Ørsted’s flagship project. The project has a planned capacity of 1,100 MW and is expected to be operational by 2024.

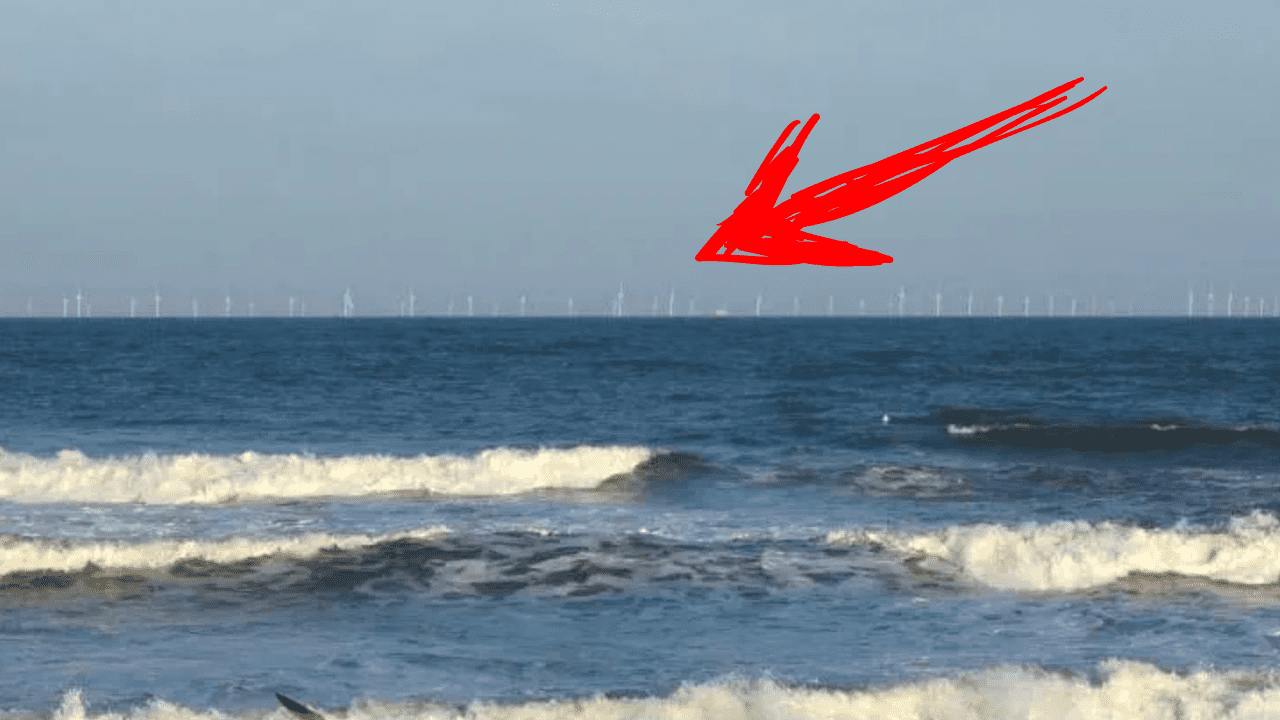

First LOOK – Wind Farms Off Of New Jersey

Ørsted also has two other project sites, Sunrise Wind, and Revolution Wind which would be located off New York State and Rhode Island.

Ocean Wind 1 is designed to be built in federal waters, which is more than 12 nautical miles from the coast and would consist of between 50 and 80 wind turbines, depending on the final turbine size chosen.

Though it will be far off the coast, the large turbines will be visible from Atlantic City all the way down to Wildwood Crest.

Ocean Wind 1

The primary reasons behind these delays and impairments can be attributed to a number of factors.

Firstly, supplier delays have posed a considerable challenge to Ørsted’s near-term US offshore development projects.

These delays have raised concerns about the suppliers’ ability to meet their commitments and contracted schedules. Consequently, this could lead to future remobilizations, potentially delayed revenue, and additional costs, resulting in impairments of up to $720 Million assuming no further adverse developments in the supply chains.

White House Approves New Jersey Wind Farm

In addition, Ørsted’s discussions with senior federal stakeholders about additional ITC qualifications for Ocean Wind 1 and Sunrise Wind are not progressing as they previously expected.

ITC is Investment Tax Credits which could be used in green energy projects like this. Ørsted is relying heavily on these types of credits to get the project going.

At the moment they are looking to qualify for additional tax credits beyond 30%. If these efforts prove unsuccessful, it could lead to impairments of up to billion dollars.

Atlantic Shores Offshore Wind Submits Project in New Jersey

Moreover, U.S. interest rates have surged significantly since the project’s initial projection, resulting in a substantial cost increase, pushing the overall project budget well beyond the billion-dollar mark. When considering additional factors, this project is now over budget by more than $2.5 billion.

Also See: When Does The Wildwood Boardwalk Close For The Season

Ørsted says they will continue to progress the offshore wind projects by obtaining final federal and local permits, working with suppliers to mitigate delays, and continuing dialogue with stakeholders.

All of these factors have now added up to Ørsted starting Ocean Wind 1 in 2026.

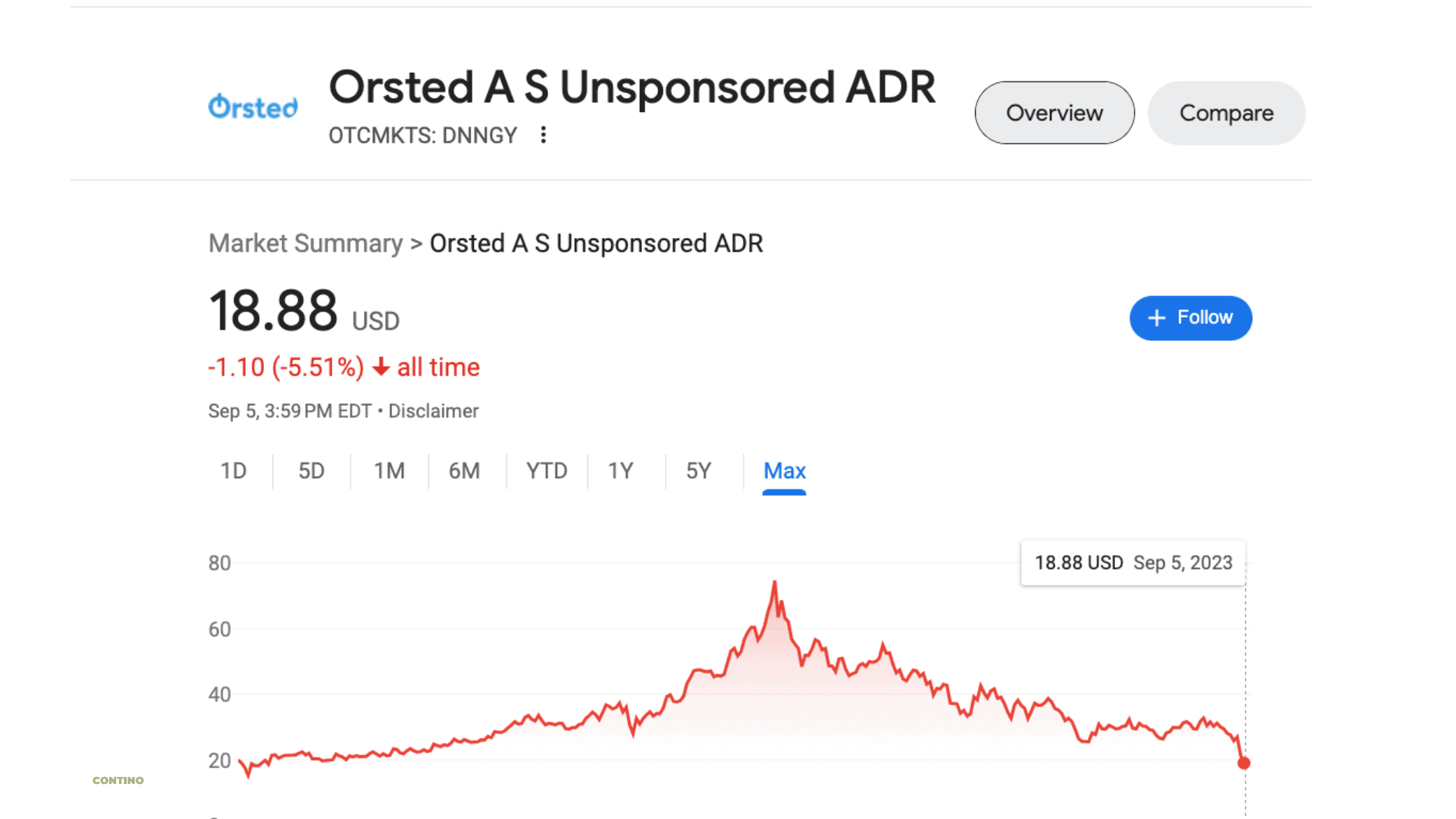

What is causing people to believe that this project could be canceled is the stock price of Ørsted? At the time of this article, Ørsted is at an all-time low of $18.88 a share. This is a massive drop since its all-time-high of $74.60 in June 2021.

The stock started dropping on the day of this press release.

With the increase in rates, massive inflation, supply chain issues, and now a massive drop in their stock price, we could be seeing the downspire of Ørsted.